Find your degree

Let’s be real – unless your family is very wealthy, no one can truly save enough to cover all of your college expenses. College tuition rates are higher than they’ve ever been – and they’ve been going up 12% every year since 2010. But with good planning, you can make the most of your college savings with good choices, from scholarships and grants to work-study and other money hacks. Read on to find out how to maximize your college savings.

Disclaimer: Online College Plan does not provide financial guidance. This Student and Parent Savings Guide is for informational purposes only and should not be considered financial advice. All data and statistics were current at time of publication.

College Savings Tips and Tricks

The earlier you save for college, the more time your money has to grow like a magic beanstalk! Even small amounts saved regularly can add up to a big pile of cash by the time your child needs it.

Get Your Child Involved: Spark your child’s interest in saving by opening a special college savings account. They can even contribute their own money from part-time jobs, birthday gifts, or allowances! This teaches them the value of saving and helps them feel invested in their future.

Account Options: Look into custodial savings accounts where your child can contribute their own money. This is a great way to combine your savings efforts and instill a lifelong saving habit in your child. By starting early, you can grow a college fund that will help your child reach their dreams!

In 2022:

- 56% of parents said they were saving for their kids’ college

- One-third of families used a 529 or similar savings plans

- The average family had $18k in college savings

- The average family’s savings could cover 10% of college costs

Related Resources:

Financial Planning: Smart Money Moves for College Students

Financial Aid Packages: An Easy Guide for Students and Parents

Money Management: Tips for College Students Understanding Finances

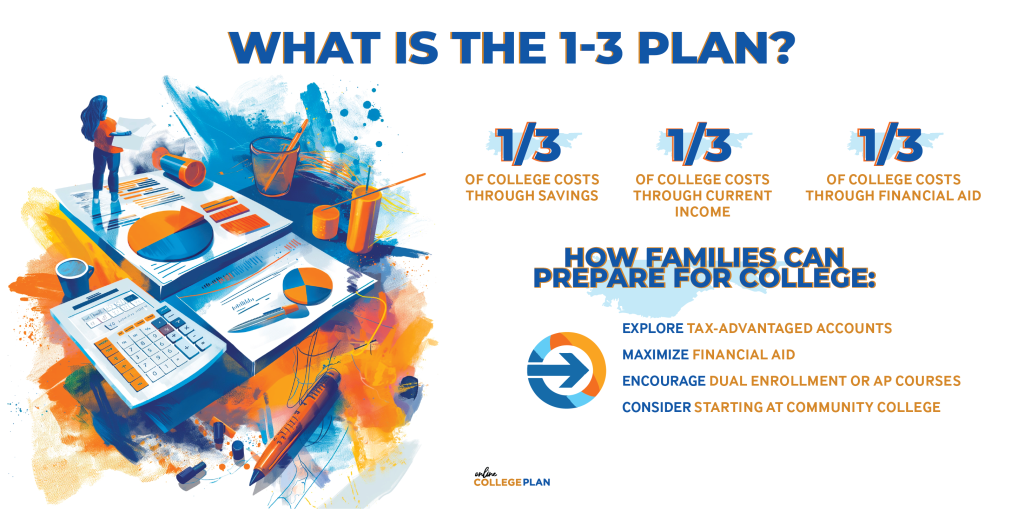

Explore Tax-Advantaged Accounts

College can be expensive, but there are special savings accounts to help you stretch your dollars further. These accounts are like secret weapons for saving for college!

Accounts like 529 plans and ESAs let your money grow tax-free. Plus, when you use the money for college expenses, you won’t owe taxes on it! Some states even give you extra tax breaks for using their own 529 plan.

There are different types of college savings accounts, so do some research to see which one works best for you. This way, you can save as much as possible while lowering your tax bill.

By using these tax-advantaged accounts, you can save smarter for college and keep more money in your pocket!

Maximize Financial Aid

Scholarships and grants are basically free cash for college. Fill out the FAFSA form to see what federal aid you qualify for. There are also tons of scholarship websites to find even more free money. Apply early – many scholarships have deadlines! This free money can help lower your college costs and reduce student loan needs.

Encourage Dual Enrollment or AP Courses

Dual enrollment and AP classes let you earn college credits while still in high school, often for less money. This can fast-track your graduation and save you money on tuition. Talk to your child’s school counselor and your local community college about these options. They can save money, give valuable learning experiences, and prepare your child for college success.

Consider Starting at Community College

Starting at a community college is a smart way to save money on college. They typically have much lower tuition than universities. You can knock out general education classes and then transfer those credits to a four-year college later. Many community colleges even have agreements with universities to make transferring credits smooth. This approach lets your child explore interests, save money, and make informed decisions about their future.

Exploring Scholarship and Grant Opportunities for College Savings

Scholarships and grants are your best strategy to lighten the financial load of college. Unlike loans, scholarships and grants don’t leave you with debt. Here’s a closer look at how you can enhance your chances of snagging these financial boosts:

- Be an Early Bird: Don’t wait! Start hunting for scholarships as soon as possible. Many have deadlines early in the year, so don’t miss out. Starting early gives you time to research, prepare, and apply without stress.

- Cast a Wide Net: Look everywhere for scholarships! Don’t just focus on local ones. Explore national foundations, companies, and even your college itself. There are tons of awards out there to help you pay for school.

- Craft Killer Applications: Every scholarship is different, so tailor your application to each one. Highlight your achievements, activities, community work, and anything else that shows you deserve the award. The more personal you are, the more likely you are to win!

- Stay Organized: With all those applications flying around, it’s easy to miss deadlines. Use a system to track dates, requirements, and what you need to submit. Spreadsheets, calendars, or apps can help you stay on top of it all. Set reminders and prioritize tasks to make sure you submit polished applications on time.

By following these tips, you’ll be a scholarship-winning machine, ready to conquer college costs!

Comparing Financial Aid Packages for College Savings

When weighing your college options, it’s crucial to carefully assess the financial aid packages offered to determine which choice makes the most financial sense. Here’s a detailed breakdown of the key factors to consider.

Grants and Scholarships

Take a close look at the amount of free money included in each financial aid package through grants and scholarships. Unlike loans, grants and scholarships do not require repayment, making them a valuable resource for reducing college expenses. Pay attention to both the quantity and quality of the awards offered, as higher amounts and renewable scholarships can significantly impact your overall financial outlook.

Loans

Delve into the details of the loans included in each financial aid package, including federal subsidized and unsubsidized loans, as well as private loans. While loans can provide immediate financial assistance, it’s essential to weigh the long-term implications of borrowing. Consider factors such as interest rates, repayment terms, grace periods, and potential future financial burdens. Aim to minimize reliance on loans and prioritize scholarships, grants, and work-study opportunities whenever possible.

Work-Study Opportunities

Investigate whether each college offers work-study programs, which allow students to earn money while gaining valuable work experience. Work-study opportunities not only provide financial support but also offer practical skills and networking opportunities that can enhance your academic and professional growth. Consider the availability of on-campus and off-campus work-study positions, as well as the flexibility of work hours to accommodate your academic schedule.

Overall Cost

Calculate the total cost of attendance for each college, taking into account tuition, fees, room and board, textbooks, transportation, and other miscellaneous expenses. Use college cost calculators and financial aid award letters to estimate your out-of-pocket expenses after accounting for grants, scholarships, and loans. Compare the net costs of attending each college to determine which option offers the most financial value. Keep in mind that the cheapest option may not always be the best fit academically or personally, so weigh all factors carefully before making a decision.

By carefully evaluating these factors, you can make informed decisions about which college offers the most cost-effective and financially sustainable choice for your higher education journey.

Budgeting for Textbooks and Other Expenses for College Savings

Textbooks and other expenses can quickly eat into your college savings, but with careful budgeting and smart spending, you can minimize costs and make your funds go further.

When I was a college student, I was able to use scholarship money to purchase books. However, some college bookstores no longer allow that, and some scholarships are only to be used for tuition.

Textbooks are a significant expense for many college students, but there are ways to save money without sacrificing academic quality. Consider:

- purchasing used or digital editions of textbooks

- renting books for the semester

- utilizing resources available at your campus library

Additionally, explore the option of sharing textbooks with classmates to further reduce costs and lighten the financial burden for everyone involved.

When it comes to other expenses, there are numerous opportunities to save money and stretch your college savings.

For instance, many colleges try to limit the number of cars on campus by making parking extremely expensive. If you live off-campus, carpooling with classmates or utilizing public transportation can help you save on parking transportation costs.

Managing textbook and surprise expenses wisely is essential for college students looking to make the most of their college savings. By prioritizing needs over wants, shopping smart for textbooks, and cutting costs where possible, you can minimize expenses and stretch your funds further. With careful budgeting and strategic planning, you can create a budget that works for you and helps you achieve your college savings goals.

What if I Just Pirate My Textbooks?

In the digital age, textbook piracy offers an easy way to save. Textbooks present a financial burden for a lot of students, and frankly, college bookstores are often predatory – no discounts, paying a fraction of the cost when they buy back your used books, and marking up used books.

The ethics of textbook piracy are a bit tricky. Some people say it’s a way to fight back against high textbook prices and unfair practices by bookstores. They argue that students should have easier and cheaper access to the materials they need for school. But there are concerns, too.

Pirating textbooks might seem like a smart way to save money, especially for students feeling the pinch. However, it can have consequences. It might not hurt the book publishers – big corporations that they are – but the people who wrote the books lose out on royalties and the motivation to write more books. Plus, there could be trouble at school if you’re caught. Some schools consider breaking copyright laws a student conduct issue.

Some college professors take a “look the other way” approach to textbook piracy. When I was a professor, I openly told my students I didn’t care how they got the books for my class. I even told them the campus bookstore was overpriced and to order used books online.

But it’s important to talk openly about the pros and cons. By having these conversations, we can work towards fairer solutions for everyone involved in education.

By implementing these college savings strategies, high school juniors and seniors, as well as current college students and their parents, can effectively manage the financial aspects of higher education. Remember to stay proactive, resourceful, and flexible in your approach to maximizing your education fund. With careful planning and perseverance, you can achieve your academic goals without undue financial stress.

FAQs

The best savings plan for college depends on your individual circumstances and financial goals. However, popular options include 529 college savings plans and Coverdell Education Savings Accounts (ESAs). Both offer tax advantages and flexibility in saving for future education expenses. It’s essential to research and compare different plans to find the one that best suits your financial planning for college.

The 1-3- rule for college savings suggests that families should aim to cover:

• one-third of college costs through savings

• one-third through current income

• one-third through financial aid

This guideline helps families balance their college savings efforts with other financial priorities and sources of funding. It may not be manageable for all families, but it is just a way of thinking about college savings.

The 529 savings strategy involves utilizing a 529 college savings plan to save for education expenses. This tax-advantaged investment account allows contributions to grow tax-free and can be used to cover qualified education expenses such as tuition, fees, books, and room and board. Families can choose from a variety of investment options and may be eligible for state tax benefits, making 529 plans a popular choice for college savings.

The quickest way to save for college is to start early and save aggressively. Maximize contributions to tax-advantaged accounts like 529 plans, consider high-yield savings accounts or investment vehicles with potential for growth, and look for opportunities to cut expenses and increase savings. Additionally, explore scholarships, grants, and other financial aid options to supplement your savings efforts and reduce the overall cost of college.

Yes, 529 plans are often worth it for many families saving for college. These plans offer several benefits, including tax advantages such as tax-free growth and tax-free withdrawals for qualified education expenses. Additionally, many states offer additional tax incentives for residents who contribute to their state’s 529 plan. Furthermore, 529 plans typically offer flexibility in terms of investment options and contribution amounts, making them a versatile tool for college savings. However, it’s essential to carefully consider your individual financial situation and goals before deciding if a 529 plan is the right choice for you.

However, 529 plans have some potential downsides to consider:

• Limited Investment Options: Although 529 plans typically offer a range of investment options, they may be more limited compared to other investment vehicles. This lack of flexibility could impact your ability to tailor your investment strategy to your specific needs and preferences.

• Penalties for Non-Qualified Withdrawals: If you withdraw funds from a 529 plan for non-qualified expenses, you may be subject to income tax on the earnings portion of the withdrawal, as well as a 10% penalty. This penalty could significantly reduce the value of your savings if you use the funds for purposes other than education.

• Impact on Financial Aid Eligibility: Funds held in a parent-owned 529 plan are typically treated as parental assets for financial aid purposes, which can have a moderate impact on eligibility for need-based financial aid. However, distributions from the plan to pay for qualified education expenses are not counted as income on the Free Application for Federal Student Aid (FAFSA).

• State-Specific Considerations: Each state’s 529 plan may have unique features, benefits, and fees. It’s essential to research and compare plans carefully to ensure you select the one that best fits your needs and goals.

• Market Risk: Like any investment, 529 plans are subject to market risk, and the value of your investments may fluctuate over time. While most plans offer age-based investment options that automatically adjust asset allocation based on the beneficiary’s age, there is still inherent risk involved.

Overall, while 529 plans offer significant advantages for college savings, it’s essential to weigh these potential downsides against the benefits and consider your individual circumstances before making a decision. Consulting with a financial advisor can help you make an informed choice.