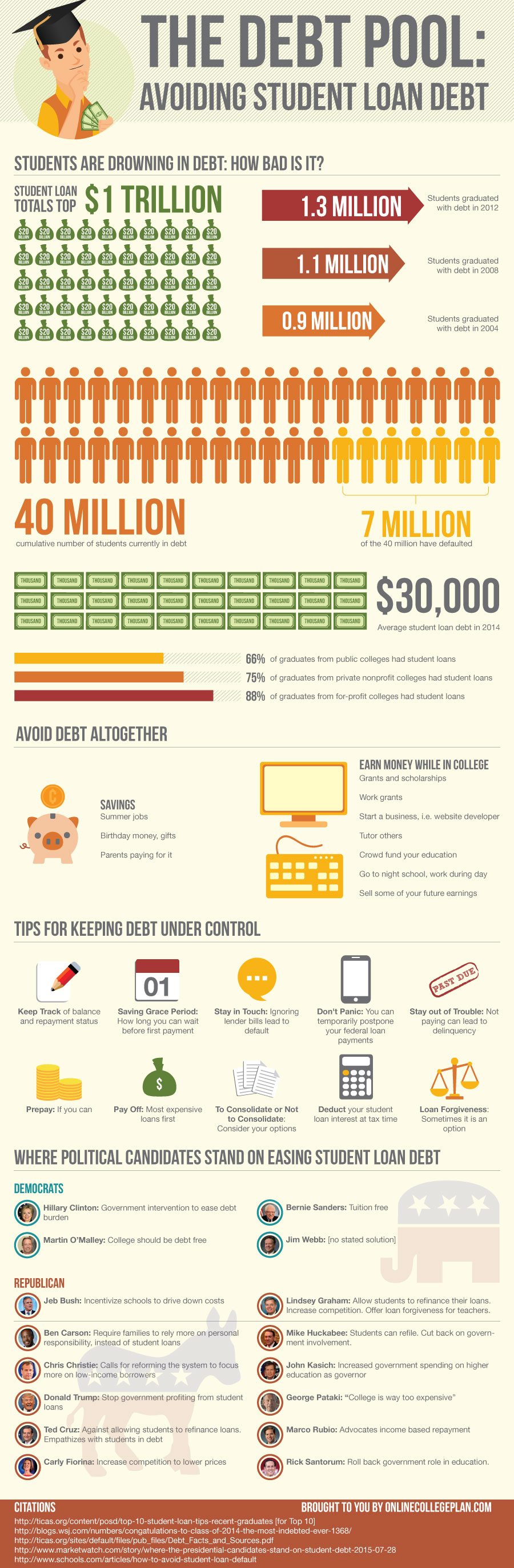

The Debt Pool: Avoiding Student Loan Debt

The Debt Pool: Avoiding Student Loan Debt

Students are drowning in debt.

How bad is it?

Student loan totals top $1.757 trillion.

17.9 million: number of students attending college each year (in the U.S.)

43.8 million borrowers have federal student loan debt

That’s more than the entire population of Canada, Poland, North Korea, Australia, and more than 200 other countries. And 4X greater than the population of Sweden.

25.6 million or 58.9% of borrowers have loans in forbearance.

Avoid Debt Altogether

1.Savings

Summer jobs

Birthday money, gifts

Parents paying for it

2.Earn Money while In College

Grants and scholarships

Work grants

Be freelance creative: write, take stock photos

Start a business, i.e. website developer

Tutor others

Crowd fund your education

Buy a sheriff sale house, renovate, flip

Go to night school, work during day

Upstart.com Sell some of your future earnings

If all else fails and you are already in debt…..

Tips for keeping debt under control

1. Keep track: Of balance and repayment status

2. Saving Grace Period: how long you can wait before first payment

3. Stay in Touch: Ignoring lender bills lead to default

4. Pick the Right Repayment Option

5. Don’t Panic: You can temporarily postpone your federal loan payments

6. Stay out of Trouble! Not paying can lead to delinquency

7. Prepay If You Can

8. Pay Off Most Expensive Loans First

9. To Consolidate or Not to Consolidate Your Loans: Consider your options

10. Deduct your student loan interest at tax time

11. Loan Forgiveness: Sometimes, it is an option

Sources:

https://ticas.org/content/posd/top-10-student-loan-tips-recent-graduates

https://blogs.wsj.com/numbers/congatulations-to-class-of-2014-the-most-indebted-ever-1368/

https://ticas.org/sites/default/files/pub_files/Debt_Facts_and_Sources.pdf

https://www.marketwatch.com/story/where-the-presidential-candidates-stand-on-student-debt-2015-07-28

https://www.schools.com/articles/how-to-avoid-student-loan-default